Optimize Payment

Posting Automation with AI

Missed or delayed payment postings lead to inaccurate financials and lost revenue opportunities. AI automates cash application quickly and precisely, transforming your payment cycle into a real-time revenue engine.

Payment Posting Automation

Payment posting is a critical step in the revenue cycle, yet it remains one of the most manual and error-prone processes. Legacy systems rely on billing teams to manually match payments to charges, reconcile remittances, and adjust for secondary claims or denials. These delays increase A/R days, reduce visibility, and introduce reconciliation issues that can cascade across financial reports and projections.

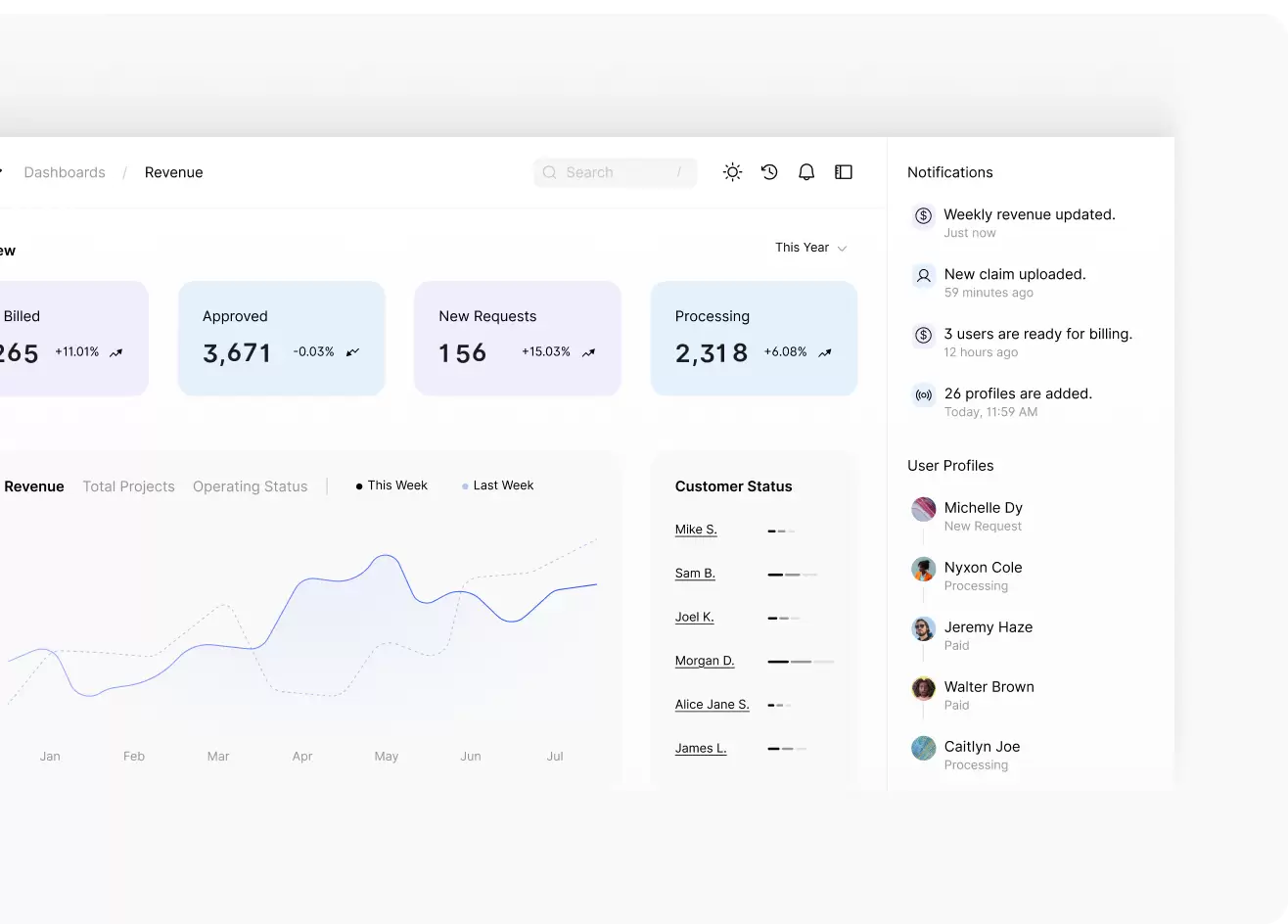

Karma Health AI automates the whole payment posting process. Our platform ingests electronic remittance advice (ERA) and explanation of benefits (EOB) data, applies payments to the correct patient accounts, and flags any mismatches or variances for immediate action. It supports multiple file formats, clearinghouses, and payer systems to ensure universal application across your organization.

AI-Powered Tools to Maximize Collections

Generative AI is transforming financial processes across industries. A 2024 study by Kumar Shamugasamy demonstrated that AI reduces processing times, enhances reconciliation accuracy, and strengthens fraud detection across global payment systems. Healthcare can harness these same benefits to eliminate payment processing friction.

Karma Health AI enables:

- Automated parsing of remittance data from all major payers

- Intelligent mapping of payments to CPT, HCPCS, and service codes

- Detection of underpayments, overpayments, and duplicate postings

- Real-time reconciliation with billing ledgers and patient accounts

- Predictive alerts for trends in payer discrepancies or timing gaps

By eliminating manual posting and reconciliation errors, practices see faster revenue recognition and a stronger foundation for cash flow forecasting.

Payment Posting Automation for Streamlined Healthcare Finance

Efficient payment posting is not just an operational advantage but a strategic lever for financial health. Delays in posting payments lead to inaccurate A/R reports, disrupted cash flow forecasting, and difficulty identifying trends in payer performance.

Karma Health AI solves these problems by:

- Posting remittances within hours of receipt

- Delivering audit-ready documentation on every transaction

- Flagging unresolved balances for appeals or secondary billing

- Enabling enterprise-wide financial visibility through a unified platform

With AI-powered payment posting, your team moves from reaction to prevention. Time spent reconciling accounts is redirected toward strategic revenue protection.

Stop Posting Delays Before They Disrupt Your Revenue

Manual payment posting creates blind spots in your revenue cycle. Karma Health AI gives your billing and finance teams a real-time advantage with intelligent payment mapping, automated reconciliation, and actionable alerts. Whether you are scaling to new locations or looking to reduce A/R days, our platform equips you to control and accelerate payment performance with precision.

We will show you exactly how many opportunities you are missing, and how

Karma Health AI can help you capture them.

Frequently Asked Questions

How does AI improve payment posting accuracy?

AI automatically extracts and matches remittance data to billing records, flagging discrepancies and ensuring our platform correctly applies payments to the proper accounts.

Can Karma Health AI post payments from all payers?

Yes. Our system integrates with central clearinghouses and payer systems, supporting Medicare, Medicaid, commercial payers, and self-pay remittance formats.

Does your platform work with our existing billing software?

Karma Health AI is platform-agnostic and integrates with most EHR, practice management, and billing systems that enterprise healthcare organizations use.

How does this help reduce A/R days?

Faster, more accurate posting shortens the time between remittance receipt and revenue recognition, reducing delays and keeping A/R aging under control.

What kind of results can we expect?

Clients typically report improvements in payment accuracy, a reduction in manual posting time, and more accurate financial reporting within the first 60 days of implementation.